The potential of any successful project cannot be realized without effective and efficient expert management. An engineering, procurement, and construction (EPC) company comes into play there. An EPC company can be very instrumental in a large infrastructure project or even in improving your operations. In this blog post, we shall discuss some of the advantages that a business can gain from engaging an EPC firm in any industry whatsoever. Cost-effectiveness, efficient project management, and access to advanced technologies and resources. Prepare for what success lies in collaborating with an EPC company. Therefore, moving on to the benefits you stand to gain by collaborating with these specialists in the respective field.

What is an EPC company, and what do they do?

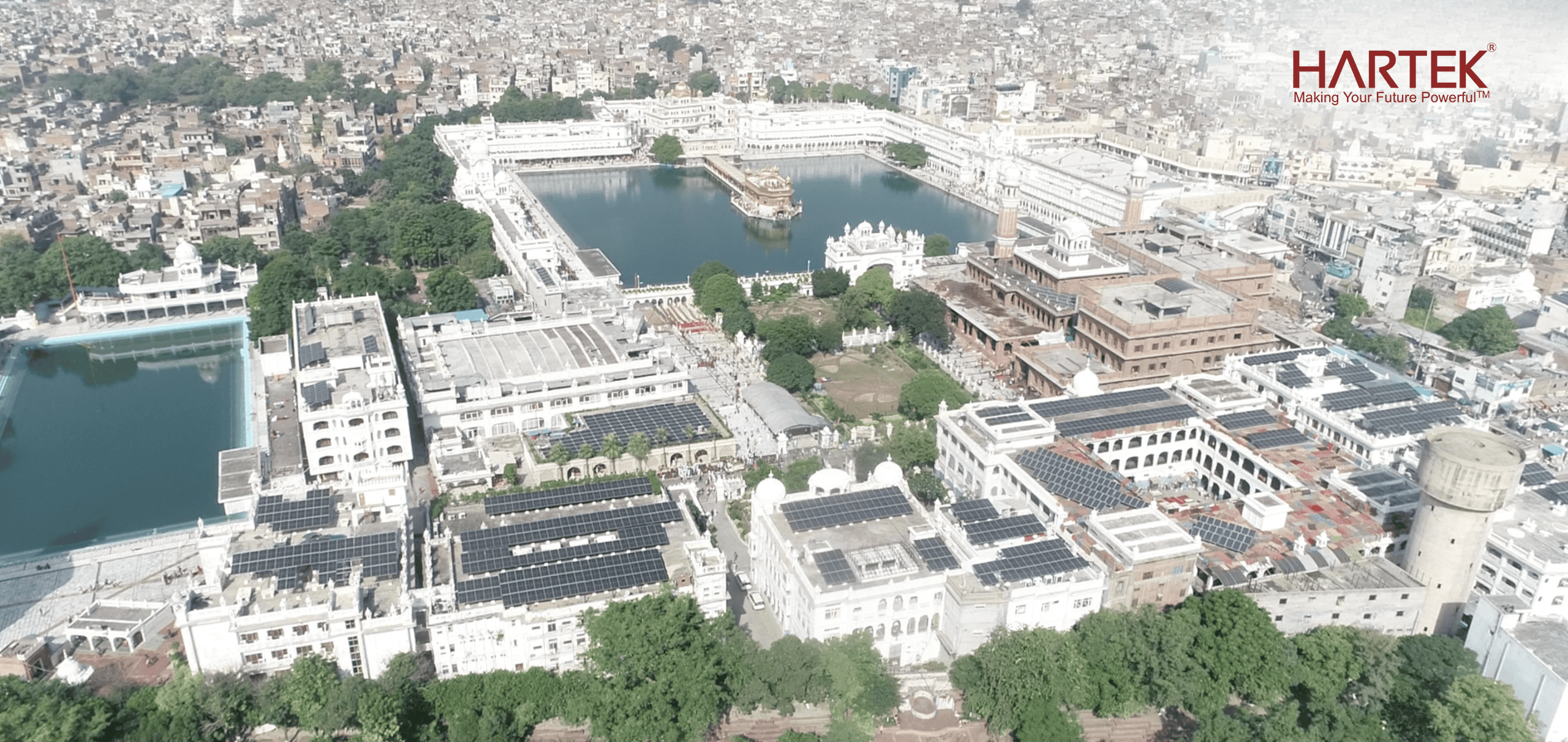

An EPC company, short for Engineering, Procurement, and Construction, is a comprehensive service provider that offers end-to-end solutions for various projects. They play a pivotal role in managing the entire project lifecycle – from concept design to construction and commissioning.

With their expertise in engineering disciplines and vast industry knowledge, engineering, procurement, and construction companies bring together diverse teams of professionals who specialize in different areas such as civil engineering, electrical engineering, mechanical engineering, and more. This multidisciplinary approach ensures that every aspect of the project is meticulously planned and executed.

The procurement aspect involves sourcing materials and equipment required for the project at competitive prices without compromising on quality. From negotiating with suppliers to ensuring timely delivery of materials to the construction site – an EPC company handles it all.

When it comes to construction management, an EPC company takes charge of overseeing the actual implementation of the project. They coordinate with contractors and subcontractors while adhering to strict timelines and safety standards.

In essence, an EPC company acts as a single point of contact responsible for managing all aspects of a project – from design optimization to cost control – resulting in streamlined operations throughout the entire process. Their aim is to deliver projects efficiently while minimizing risks and maximizing value for their clients.

How does working with an EPC company benefit businesses?

Cost-effectiveness and efficiency

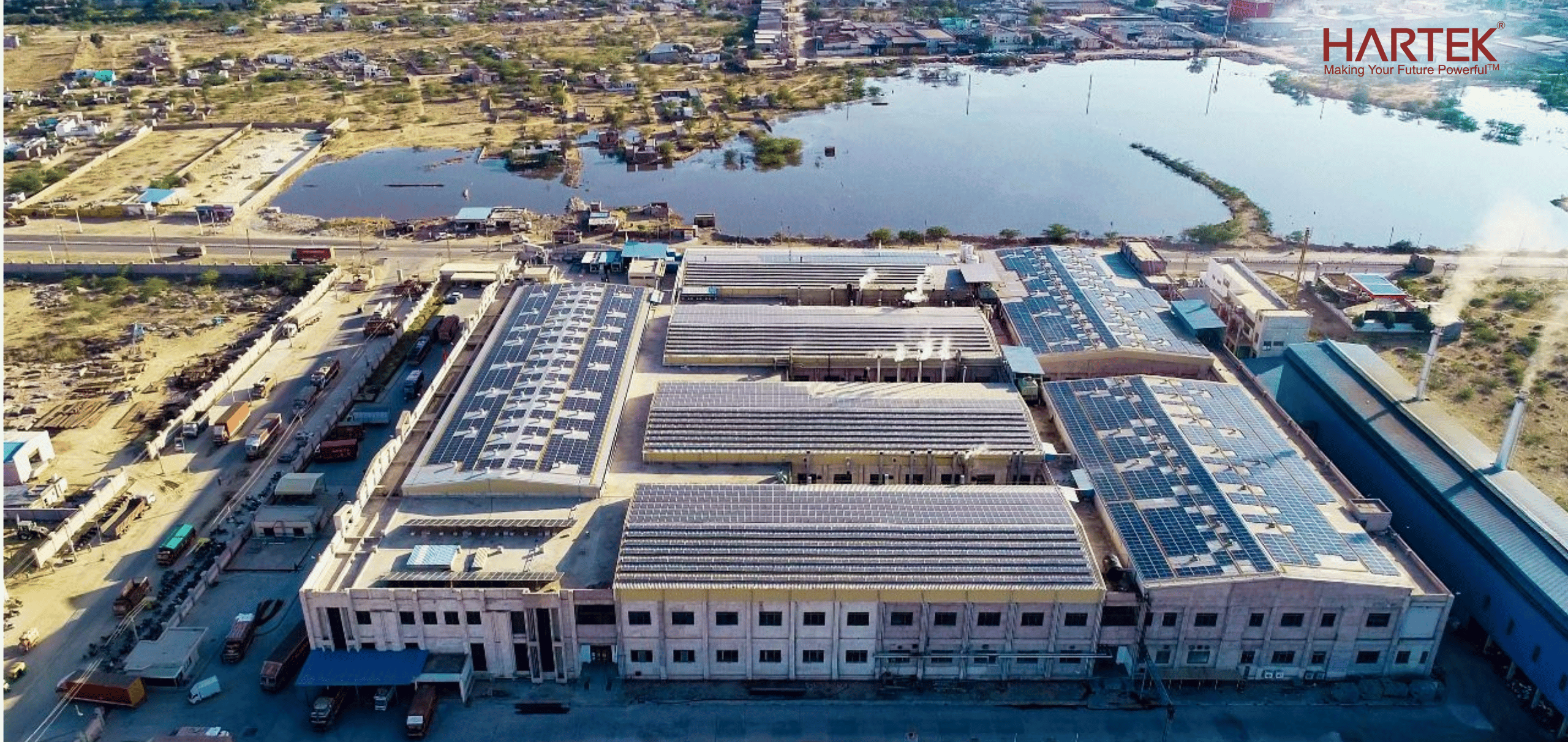

Cost-effectiveness and efficiency are two key benefits of working with an EPC company. By entrusting your project to professionals who have expertise in engineering, procurement, and construction, you can achieve significant cost savings without compromising on quality.

One of the ways that leading EPC companies in India help businesses save costs is through their extensive network of suppliers and contractors. They have established relationships with trusted vendors, enabling them to negotiate better prices for materials and services. This translates into lower costs for the client.

Moreover, EPC companies are skilled at optimizing project schedules and resource allocation. They carefully plan each phase of the project to ensure smooth execution within the stipulated time frame. Their experience allows them to identify potential bottlenecks early on and take proactive measures to avoid delays.

Streamlined project management

Streamlined project management is one of the key benefits of working with an EPC company. With their expertise in handling complex projects, these companies are adept at ensuring that every aspect of the project runs smoothly and efficiently.

One way they achieve this is through effective planning and organization. EPC companies have a systematic approach to project management, which includes defining clear objectives, setting realistic timelines, and allocating resources effectively. This helps to minimize delays and keep the project on track.

Another aspect of streamlined project management is effective communication. EPC companies understand the importance of regular communication between all stakeholders involved in the project – from clients to contractors to suppliers. They ensure that everyone has access to relevant information, updates, and instructions throughout the entire process.

Expertise and experience in diverse industries

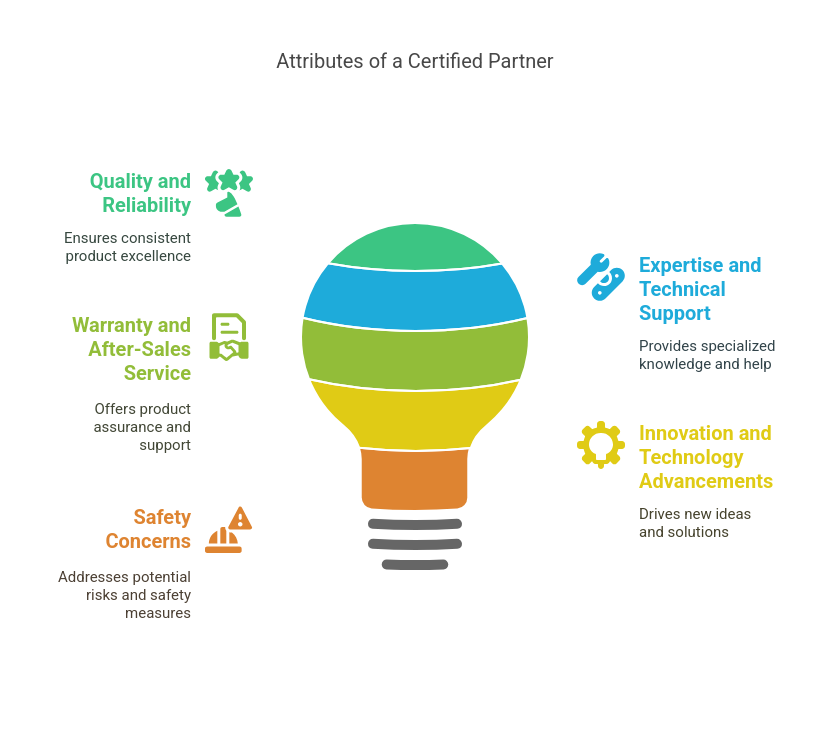

When it comes to working with an EPC company in India for power, one of the key benefits is their expertise and experience in diverse industries. These companies have a deep understanding of various sectors, ranging from oil and gas to power generation, infrastructure development to renewable energy.

With their extensive knowledge and exposure to different industries, EPC companies bring valuable insights and best practices that can greatly benefit businesses. They are equipped with the skills and know-how necessary to navigate complex projects within specific sectors. This means they can provide tailored solutions that meet industry-specific requirements and regulations.

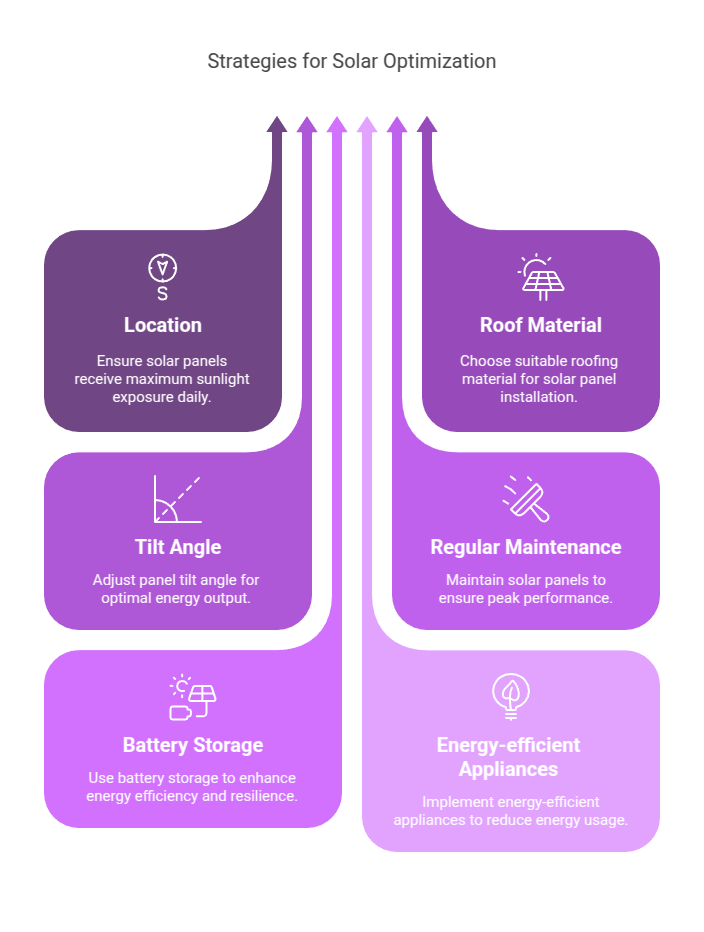

Access to advanced technology and resources

Access to advanced technology and resources is another significant benefit of working with an EPC company. These companies are constantly investing in the latest technologies, tools, and equipment to stay at the forefront of their industry. By partnering with an EPC company, businesses gain access to these cutting-edge technologies and sustainable development processes without having to make substantial investments themselves.

One advantage of this access is improved efficiency. Advanced technology can help streamline processes and increase productivity. For example, EPC services often utilize sophisticated project management software that allows for real-time collaboration and tracking of tasks. This not only speeds up project timelines but also ensures better communication and coordination among team members.

Furthermore, EPC companies in India for infrastructure often have well-established relationships with engineering firms and manufacturers around the world. This enables them to source high-quality equipment at competitive prices for their clients’ projects.

Conclusion

Collaborating with us, an EPC company in India with a commitment to innovation is undoubtedly advantageous for any business looking for comprehensive support throughout the entire project lifecycle. The combination of cost-effectiveness through consolidated contracting arrangements alongside streamlined project management practices ensures successful outcomes while allowing organizations to focus on what they do best – growing their core business activities!