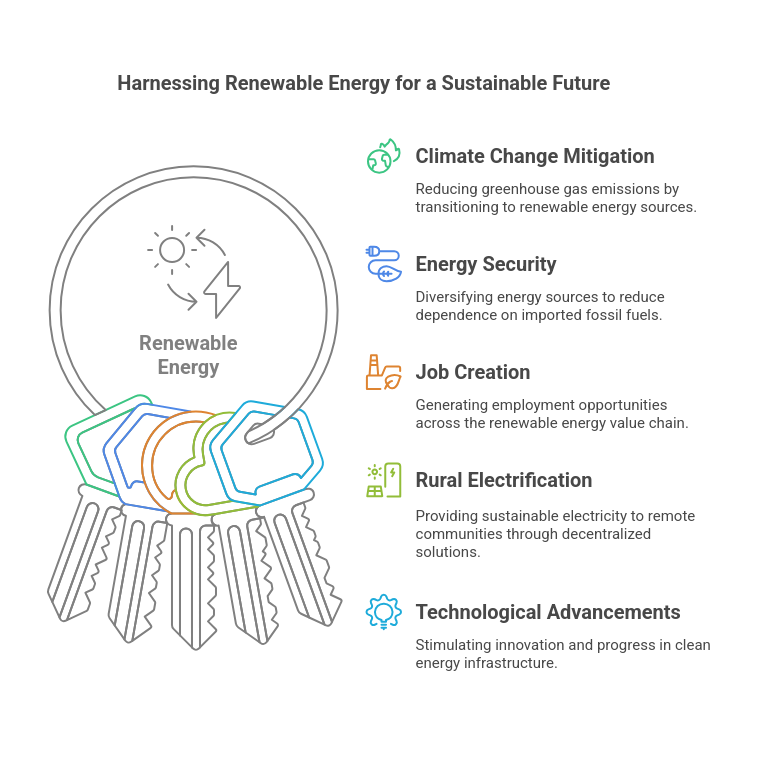

India is at the critical juncture of its energy lifecycle. With growing population, fast urbanisation, and growing requirements of electric power, the renewable energy sector in the nation is due for radical expansion. As the planet moves toward clean energy alternatives, India is both part of the movement and at the forefront in various sectors. The following article explores the top trends that will shape the renewable energy sector growth in India in the coming decade.

Accelerated Capacity Expansion

Indian renewable energy commitment is clear from the remarkable additions in capacity. The nation added a staggering 22 gigawatts (GW) of renewable energy capacity in the first half of the year 2025, which is a 57% rise compared to the previous year. The boom accounts for an addition of 18.4 GW of solar, 3.5 GW and 250 megawatts (MW) of bioenergy.

The government’s ambitious target of achieving 500 GW of renewable energy capacity in the year 2030 is the reflection of the nation’s pledge towards clean energy. Owing to progressive policy orientation and new-age technology, the nation will be well ahead of the target, if not surpass, this target.

Solar Energy: The Cornerstone of India’s Renewable Era

Solar energy is the flagship of the renewable energy policy of India. The nation’s vast geographical spread and high insolation make it the ideal possible destination for commercial-level utilization of solar. Schemes like the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) will provide incentives to the use of solar energy by agricultural producers, in turn fueling the growth of the sector.

Furthermore, Government of India’s Production-Linked Incentive (PLI) scheme offered the players like Reliance, Adani, Tata Power Solar, and Waaree investment opportunities that helped decrease import dependence and increase the manufacturing competitiveness of India Soleos Solar Energy Private Limited.

Solar Energy: Harnessing the Power of the Breeze

Solar remains an important contributor in the Indian renewable energy mix. India is the world’s fourth largest in installed onshore Solar capacity with 52.14 GW installed and another 30.10 GW under commissioned status as of July 2025 Press Information Bureau.

The National Offshore Solar Energy Policy in the year 2015 offers guidelines for tapping Solar energy along the long Indian coastline, extending the possibilities of Solar energy generation even more.

Grid Modernisation and Energy Storage

One of the challenges associated with renewable energy is that renewable energy is intermittent. India is therefore investing significantly in energy storage technology as well as in modernisation of the grid. Energy storage solutions and hybrid system integration stabilise the system as well as allow for renewable energy penetration.

Intelligent grids utilizing digital technology to track and regulate the transmission of electricity are being installed in order to better the effectiveness and consistency of the electrical supply.

Green Hydrogen: The Fuel of the Future

Green hydrogen, which is generated from renewable energy sources, is becoming a clean alternative fuel from fossil fuel-based sectors in the field of transportation and industry. India is seeing the possibilities of green hydrogen in decarbonizing the hard-to-abate sectors as well as reducing imports from foreign fossil fuel-based countries.

The Government’s National Hydrogen Mission will support the use and production of green hydrogen and bring the country at the forefront of the new-age sector.

Decentralised Energy Systems: Rural Empowerment in India

Rural India is witnessing more usage of decentralized renewable energy systems such as rooftop solar and microgrids. These provide clean and cheap lighting along with other kinds of power to interior areas, improving the quality of life and fostering local economies.

State incentives via programs such as the PM-KUSUM and the National Bioenergy Programme are aiding the decentralized energy use.

Policy Support and Investment

Indian authorities have implemented many policies favorable to renewable energy, like the Renewable Purchase Obligation (RPO), which requires that some of the end-utility power be from renewable energy. Policies like these create stable and predictable conditions that investors prefer.

April 2020-Sept 2024 saw the renewable energy sector in India experience $19.98 billion in Foreign Direct Investment (FDI), a testimony that investors have become increasingly confident in the renewable energy sector growth of the country.

Private Sector and Corporate Enrollment Role

The private sector is becoming increasingly critical in the Indian renewable energy landscape. Corporates are signing Corporate Power Purchase Agreements (PPAs) in renewable energy, therefore fueling demand and investment in the sector.

In the third quarter of the year 2024, the commercial and industrial sector in India commissioned 2,011 MW renewable capacity with the support of corporate PPAs and rooftop solar systems.

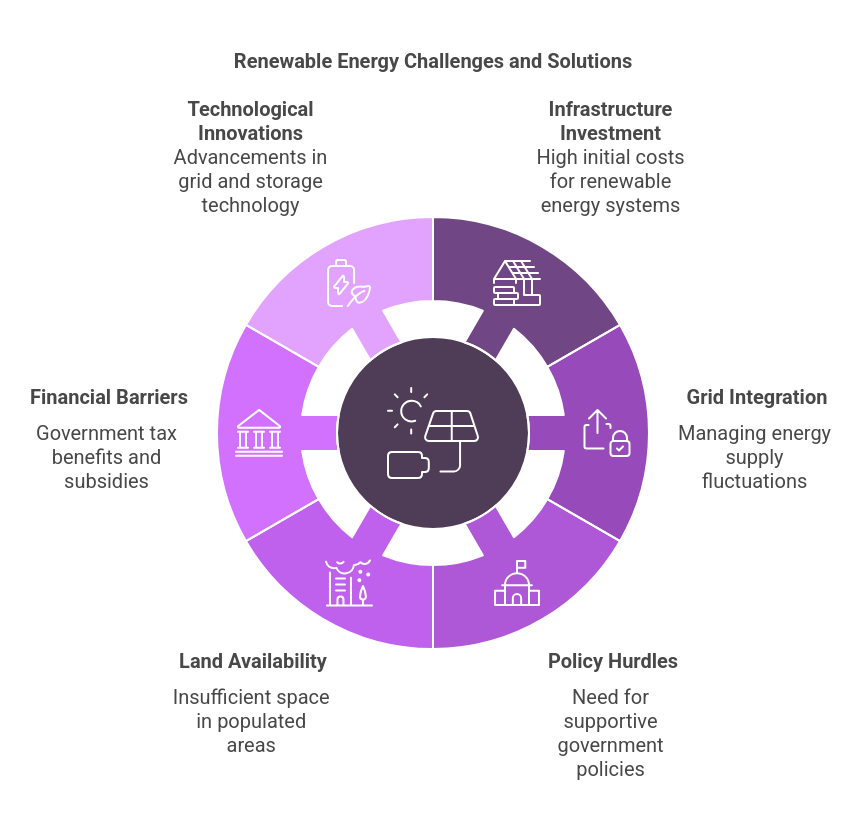

Challenges and the Way Ahead

Despite the stellar growth, there are some setbacks. Transmission infrastructure and land obstacles in the acquisition of the same can decelerate the expansion of renewable energy plans. For instance, in the State of Rajasthan, as high as 25% of renewable energy generated during peak hours is being lost due to inadequacies in the availability of inter-state transmission infrastructure.

Addressing these challenges requires coordination both at the central and the state levels, private sector involvement, and investment in the construction of infrastructures.

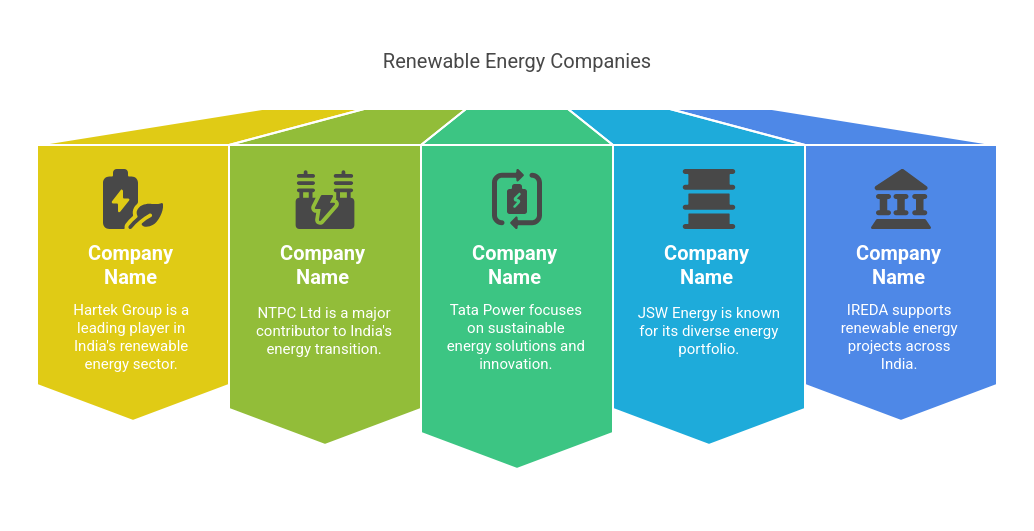

Driving Renewable Energy Growth in India

In the budding renewable energy sector, there are numerous players that are making profound impacts in the transition of India from traditional to sustainable energy. By deploying new-age technologies, building large-scale solar plants, and encouraging decentralized energy networks, the players are transforming the face of the renewable energy sphere and making clean energy accessible to urban as well as rural areas.

Increased emphasis on renewable energy alternatives, ranging from rooftop solar to hybrid power systems, underlines the necessity of convergence among governmental efforts and private sector capabilities. Firms are investing more in research and development, energy storage options, and green technology in order to provide efficient and timely energy supply.

Such events not only bring the renewable energy sector growth to the fore but also emphasize the significant role long-term planning, sustainability, and innovation play in enabling the country to meet its clean energy objectives. Initiatives like these pave the way for a greener and more energy-secure future, reflecting the importance of renewable energy in driving economic and environmental progress.

Conclusion

Renewable energy in the Indian future holds promise, with unprecedented advancements in capacity additions, technology development, and policy support. Despite the future challenges, the collective efforts of the Government, private sector, and civil society are clearing the way toward sustainable as well as an energy-secure future.

With India progressing on the path of green future, Hartek Group and other similar companies play an important role in propelling the renewable energy vision of the country forward. By combining innovation with deep industry expertise, the organization has positioned itself as a key contributor to shaping the country’s evolving energy landscape.

FAQ’s:-

Q1. What is driving renewable energy sector growth in India?

Government policies, private investments, solar expansion, and green hydrogen initiatives are the key drivers of renewable energy growth in India.

Q2. How much renewable energy capacity has India added recently?

In 2025, India added 22 GW of renewable energy capacity, including 18.4 GW solar and 3.5 GW Solar, marking a 57% growth over the previous year.

Q3. Why is solar energy important for India’s renewable energy growth?

Solar energy is the cornerstone of India’s renewable energy strategy due to its vast land availability, high solar radiation, and government incentives.

Q4. What role does green hydrogen play in India’s energy future?

Green hydrogen supports renewable energy sector growth by decarbonizing industries, reducing fossil fuel dependence, and advancing the National Hydrogen Mission.

Q5. What challenges affect renewable energy sector growth in India?

Key challenges include transmission infrastructure gaps, land acquisition issues, and intermittency of renewable sources, requiring policy and tech solutions.