Installing The New Renewable Energy Demand Capacity Has Its Due Share Of Problems But Integrating It With A Nascent Grid Poses A Much More Formidable Challenge.

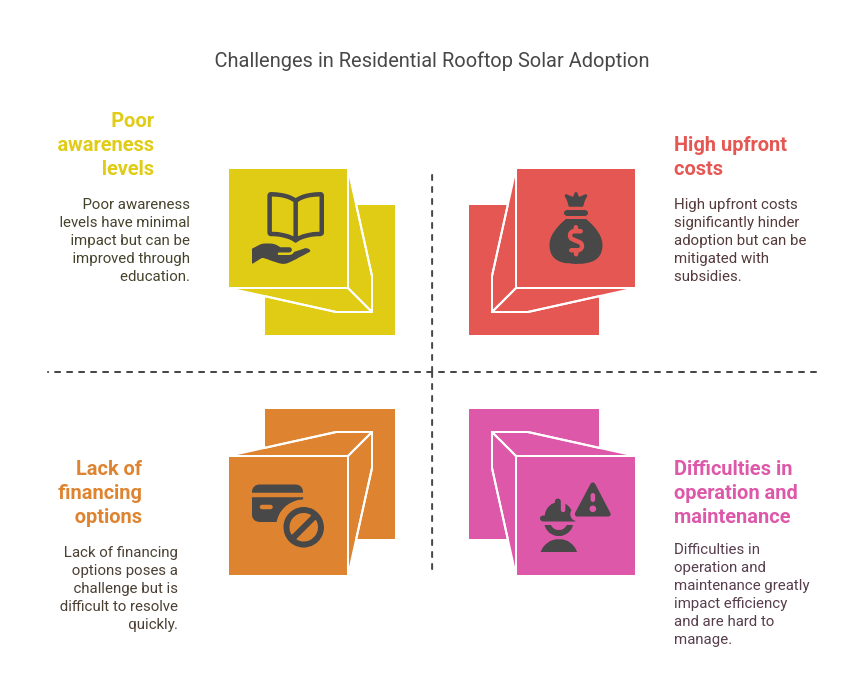

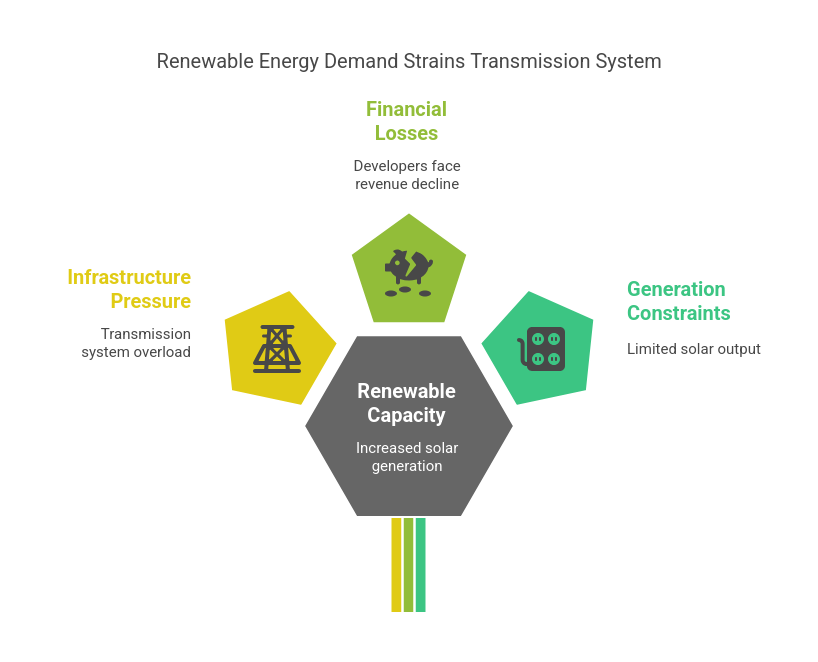

Up against a staggering renewable energy demand target of 175 GW by 2022, India has its task cut out. Installing the new capacity has its due share of problems but integrating it with a nascent grid poses a much more formidable challenge. The country’s solar power generation capacity has gone up 32 times in a span of just six years, from 0.5 MW in 2011 to 16 GW now, but the transmission infrastructure is far from prepared to evacuate the kind of solar power being injected into the grid.

Power Generation: Renewable Energy Demand

With the transmission system failing to keep pace with the increase in solar power generation, the glaring mismatch is bound to put immense pressure on the present transmission infrastructure, a situation which we can ill-afford bearing in mind the high stakes in the solar sector. Hartek Group, a leading player in renewable energy solutions, emphasizes the need for robust grid infrastructure to support the growing solar capacity.

We still have lessons to learn from India’s worst blackout of 2012, which plunged the entire North India into darkness for two days. Given the sporadic nature of electricity from clean energy sources like solar and wind, there is a need to ensure the transmission infrastructure is capable of handling the sudden surges in electricity during peak hours. With the evacuation system not yet ready, we are witnessing a situation where solar plants are being constrained to restrict generation, which is resulting in huge financial losses to developers.

Green Energy Corridors:

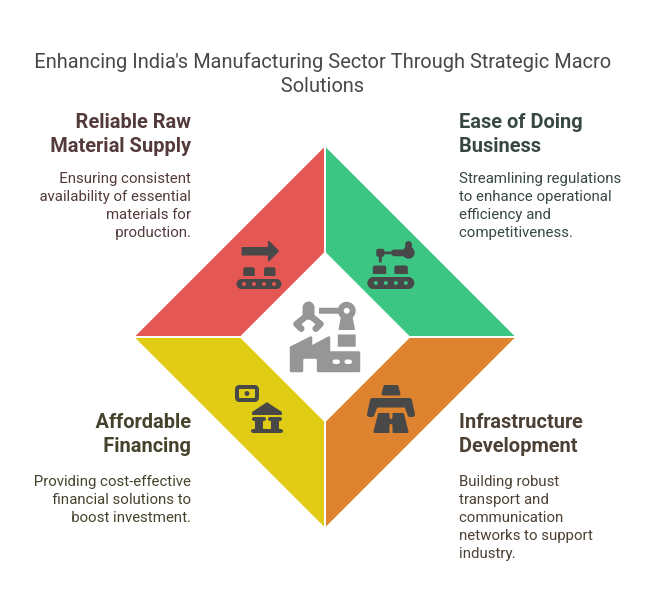

Though the government has embarked on a $3.5-billion Green Energy Corridors (GEC) programme to overcome these challenges of power evacuation by strengthening the grid network, it is a daunting task which has to be taken up on a war footing to be able to deliver the desired results. The biggest challenge before us is to ensure that transmission systems are in place before the solar projects are ready. Considering that executing transmission projects takes up to five years as compared to 12-18 months for solar projects, we need to act urgently and decisively.

The GEC programme needs further push in order to ensure sufficient thrust from the industry in solar-rich states like Gujarat and Rajasthan. The mismatch between the number of demand centers and the available corridors is also a major concern. For instance, the 1,000-MW substation project at Kaythar in Tamil Nadu, which was scheduled to be commissioned earlier this year, has yet not seen the light of day for the simple reason that independent power producers are more inclined to evacuate the power to Gujarat and Maharashtra rather than the Northeast through the planned corridor. Distance can also be a major issue in India with six states in the western and southern parts accounting for 80% of the country’s installed solar capacity but only 38% of the power demand. The GEC programme is aimed at evacuating power from renewable energy-rich states to other states through 765 kV and 400 kV high-voltage transmission lines.

With storage facilities for solar energy lacking, how we manage the power generated at a specific point presents a stiff challenge. Maintaining grid stability can pose a major problem when a large amount of solar power is injected into the grid. Things can become even more difficult when the share of renewable energy in total power generation goes up in due course of time, but the constant flow of power is still lacking. The situation can, however, be overcome with modern technological breakthroughs and advancements like smart grids and solar energy storage solutions. Since many large solar facilities are in remote locations like deserts where grid infrastructure does not exist, we need to find a viable way to connect to and store solar energy, as and when needed. Bearing this in mind, the three-year action plan formulated by the Ministry of New and Renewable Energy has asked the Solar Energy Corporation of India to focus on storage solutions.

Though there has been considerable progress in coordinating generation and transmission at the state level to ensure sufficient in-state transmission, a lot more remains to be done. States should take it upon themselves to avoid delays in project execution by providing last-mile connectivity between inter-state and intra-state transmission lines, which is part of their responsibility. While the work at the national grid level is making some progress, the inadequate preparedness of states at the distribution grid level is a cause for concern.

Solar Power Developers:

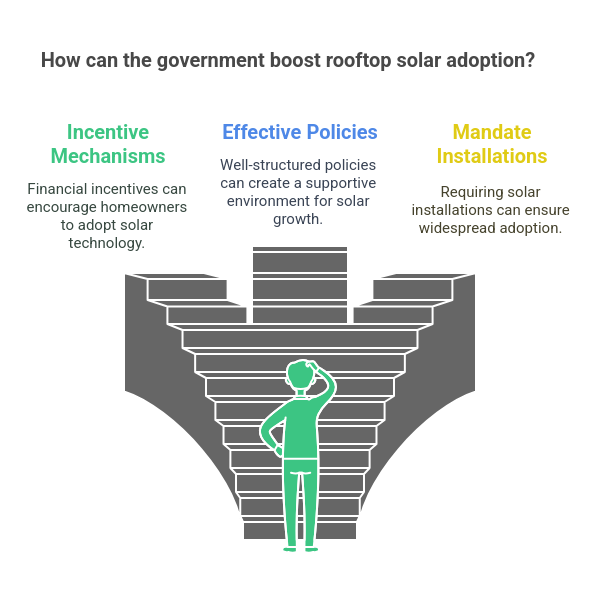

Some of the states have even started asking wind and solar power developers to curtail generation in view of the insufficient transmission capacity. As a result, project developers are incurring revenue losses. To counter the situation, the Ministry of New and Renewable Energy has issued an advisory asking state power utilities not to direct renewable energy developers to reduce generation.

The inter-state transmission corridor being developed by Power Grid Corporation of India will help only if the transmission utilities in states supplement the effort by developing and strengthening their transmission infrastructure. Only then can we exploit the renewable energy potential of places like Ladakh and Jaisalmer and meet the growing power requirements of regions with high consumption. On the brighter side, states need not be worried about fulfilling their renewable purchase obligations, considering that the renewable energy costs are expected to decline once the inter-state sale of renewable energy picks up through the green energy corridor. Making the proposition even more viable, they have been exempted from paying the inter-state transmission system charges.

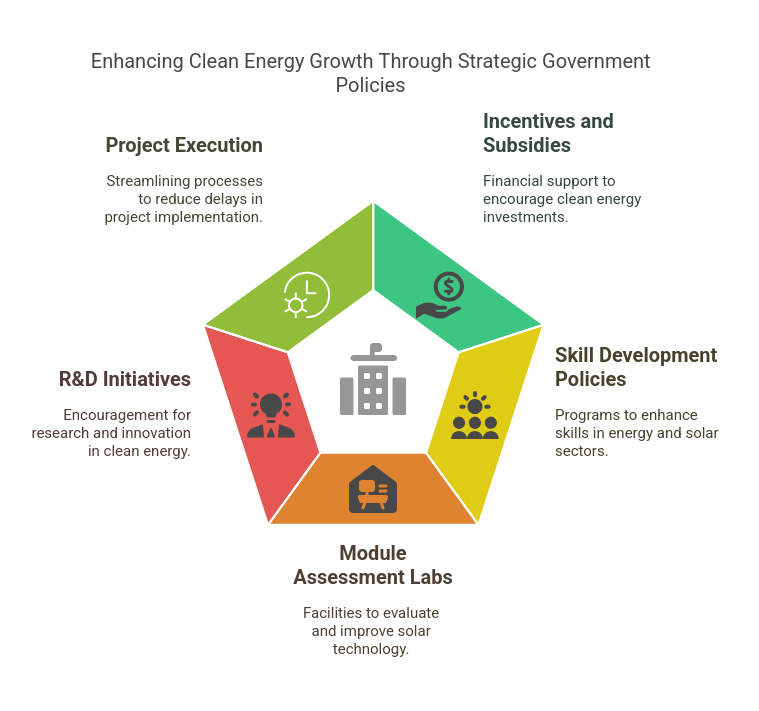

However, the efforts have to be doubled. There is a dire need to have a mechanism in place to ensure coordination between renewable energy generation and transmission at the state level so that there is sufficient in-state transmission. The scheduling and dispatch between states and regions must also be coordinated on priority. The government should come up with regulatory and policy guidelines which optimize cost-effective capacity expansion. In view of the intermittent nature of renewable energy, it is imperative to equip states with state-of-the-art renewable energy forecasting tools.

The Green Energy Corridor needs to be significantly widened so as to accommodate 50 more ultra-mega solar parks, in addition to the 34 under construction. While upgrading the transmission infrastructure to cater to the ever-growing needs of the future, Hartek Group emphasizes that the government should also not lose sight of the fact that the country’s per capita power consumption is projected to grow four times by 2030. These factors call for massive investments in the T&D segment for which private participation is a must. It is time for the policymakers to ensure the power sector is ready for the turnaround.

FAQ’s:-

1. What is driving the demand for renewable energy in India?

The growing need for sustainable power, government initiatives, and rising energy consumption are fueling renewable energy demand in India.

2. How does grid infrastructure impact renewable energy demand?

Inadequate grid infrastructure limits the ability to transmit and store solar and wind energy, creating challenges in meeting rising renewable demand.

3. What are Green Energy Corridors (GEC) in India?

Green Energy Corridors are transmission networks designed to evacuate renewable energy from solar-rich states to demand centers across India.

4. How does renewable energy storage affect demand?

Limited storage capacity hinders consistent power supply, impacting the reliability of renewable energy and slowing down its demand growth.

5. What role does policy play in meeting renewable energy demand?

Government policies promoting grid expansion, energy storage, and renewable purchase obligations are vital in meeting India’s energy demand.